Investing in Sports Cards: Debunking Assumptions and Outlining Strategies

The discourse surrounding the investment potential of sports cards is marked by fervent opinions on either side of the spectrum. Yet, it’s important to acknowledge that the issue is multifaceted and doesn’t neatly fit into a binary categorization.

In this article, I aim to elucidate the concept of investment, elucidate why sports cards can be considered investments, and delineate my preferred approach.

Defining Investment Consulting the dictionary, you’ll find a variation of this definition:

“An investment is an asset or item acquired with the goal of generating income or appreciation.”

When people engage in discussions about “investing in sports cards,” this is often the definition at the forefront of their minds. They’re procuring an asset with the intent to reap profits from it down the line.

Sports Cards within this Definition

Opponents of classifying sports cards as investments might stumble over the nature of cards as assets, the volatility in card prices, and the associated risk level.

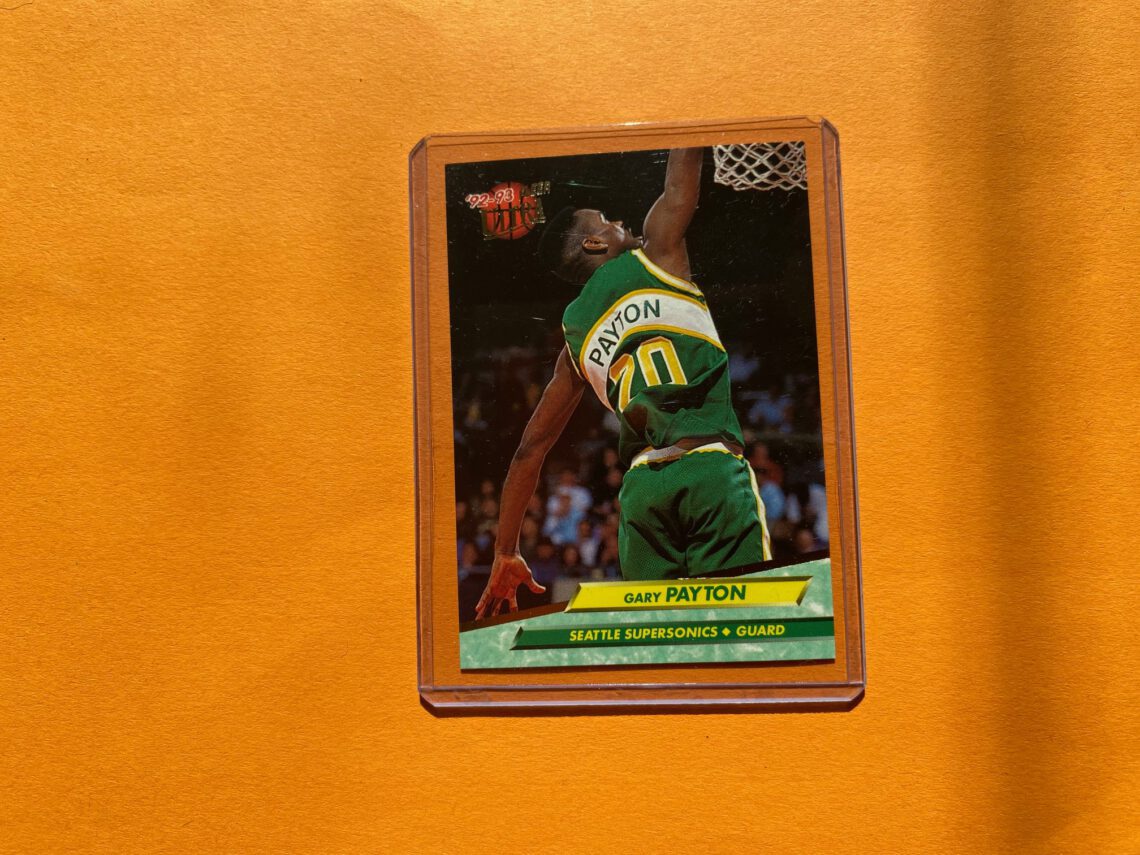

Sports cards differ from conventional investments such as stocks, which derive their value from underlying business assets and income, bonds tied to future income streams, and real estate linked to rents or property value. Cards, essentially a photo on cardboard, lack inherent value – their worth hinges on others’ willingness to pay. Despite this, cards qualify as assets, commanding buyers’ expenditure and holding potential for profitable buying and selling.

Collectibles fall into the realm of “alternative investments,” and financial advisors commonly caution against disproportionately allocating funds to such assets due to their inherent risk. Collectibles’ value is capricious, with sports cards exhibiting significant fluctuations over decades, rendering them precarious investments.

This may explain the intense debate. Concerns arise that individuals will forsake traditional retirement savings vehicles like 401(k) plans and IRAs, channeling their resources into untested prospects. A judicious approach advocates dedicating a modest portion of one’s net worth to sports cards and collectibles.

While certain cards have translated into substantial gains and losses, it’s essential to recognize that traditional investments—stocks, bonds, and real estate—follow the same pattern. Not every card or stock yields handsome returns.

In summary: A venture might not be deemed a “wise investment” or warrant significant capital, yet it doesn’t preclude it from adhering to the investment definition.

My Approach to Sports Card Investment When discussing sports card investment, many imply purchasing a card and waiting for its value to appreciate.

My approach embraces minimal risk, yielding consistent cash flow and profits.

Arbitrage entails acquiring an asset on one platform and promptly reselling it at a higher price on another. This strategy exploits market inefficiencies for lower-risk investments.

For example, I’ve discovered cards in $0.25 boxes at shows and resold them on eBay the same day for $3-$5. I purchase collections from Facebook Marketplace at $0.005 per card, immediately selling on Sportlots for $0.18-$0.25 each. Investing in inventory facilitates capitalization on pricing disparities between platforms.

Critics might argue, “That’s labor, not investment.” True, it involves work, yet effort is intrinsic to any investment. Evaluating stocks, mutual funds, or real estate, researching prior to acquisition, examining quarterly filings, and conducting buying and selling entail labor if one aims for success.

In Conclusion Both traditional investments and alternatives (like sports cards) entail acquiring an asset to garner profits.

That’s the crux.

And it fulfills the investment definition.

Risk level, proportion of net worth, and intelligence of investment are pivotal considerations, but they don’t impinge upon categorizing sports cards as investments.

Drawing on my financial background and comprehensive research, this article encapsulates my viewpoint. I acknowledge dissenting perspectives and, in those discussions, share sources reinforcing my stance. I’m yet to encounter anything beyond subjective opinion from dissenters. I’m open to examining research, sources, or studies that present an alternate view – please feel free to share these in the comments below.

Dialogue and debate foster learning and growth.

Also, in case you missed it, I’ve launched a new podcast – the WaxPackHero Sports Card Minute! Available directly on the site’s Podcast link or on platforms like Apple Podcasts, Spotify, Google Play, and TuneIn. Check it out, share your thoughts, and spread the word!

Jasper Krulick

I have been collecting memorabilia for half of my life. I started very small with a few trading cards and since then I am more and more interested in the subject. I read a lot in Facebook groups, collect especially Jordan memorabilia. I'm happy if you like my content.

You May Also Like

Raiders Memorabilia: A Touch of Silver and Black History with Price Tags

March 29, 2023

Adidas D.O.N.: Game-Used Donovan Mitchells Pieces

September 21, 2023