There is a significant market for high-value collectible cards. To most people, except for a few, the idea of these cards being worth millions of dollars is mind-boggling. For those unfamiliar with this world, it can seem perplexing, but to those well-versed in it, individuals like Gary Vaynerchuck are influential figures who stir things up.

Gary Vaynerchuck’s voice may be jarring, but it’s captivating. Even though his explanations are often oversimplified, occasionally, he touches on intriguing topics. However, his opinions are sometimes ungrounded.

In this discussion, we’ll dissect what he said, sorting out the truths from the falsehoods and providing essential information for anyone considering entering the world of high-priced, scientifically-graded collectible cards.

Collecting sports cards and memorabilia has been an American pastime for over a century, dating back to the early 1900s when tobacco companies began inserting them into cigarette packs. Baseball cards, for example, have been around since the 1860s.

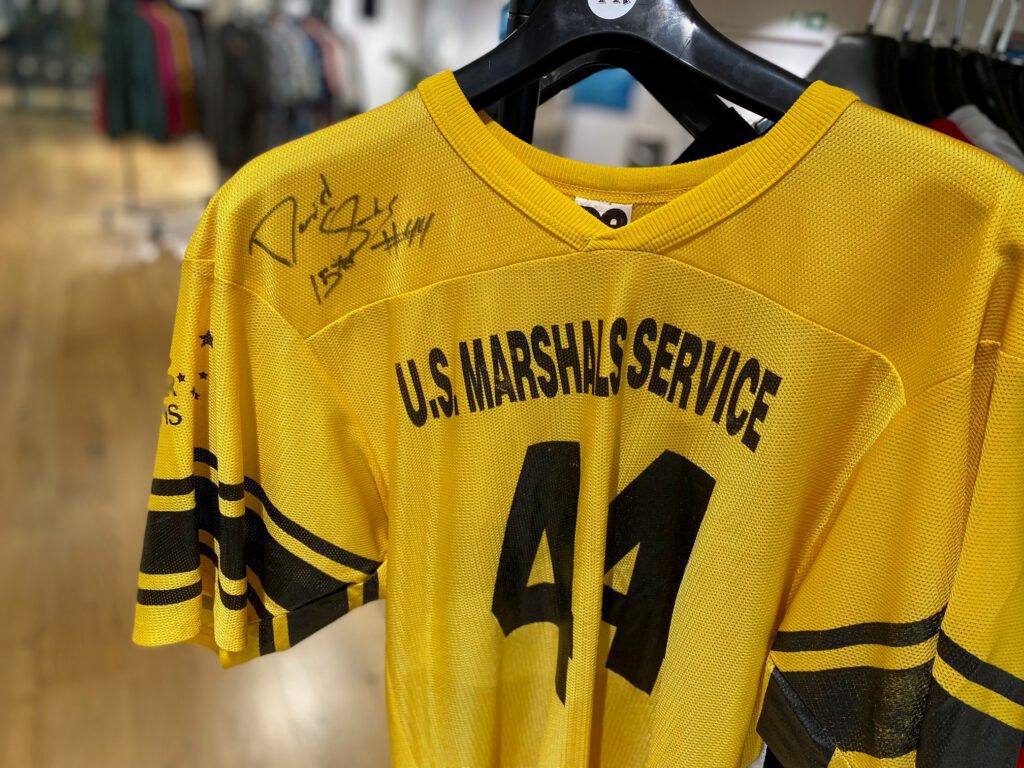

Over the years, numerous companies have entered the market, partnering with athletes to obtain autographs, jersey fragments, and other collectible items. Legal disputes have also arisen between card companies, players, and sports leagues. Many of these cards are subjected to scientific grading to authenticate their origin and assess their condition with absolute certainty.

However, hidden beneath the frenzy is a sobering truth: most sports cards and memorabilia have little intrinsic value. This raises questions about why card manufacturers would produce items intended to appreciate to staggering heights in the future.

The Wagner T-206 Card

An iconic example is the Johannes Peter “Honus” Wagner T-206 card, produced between 1909 and 1911 by the American Tobacco Company. While Wagner was an exceptional baseball player, he wasn’t necessarily the greatest of all time. However, his card has become a timeless masterpiece due to unique circumstances. Wagner requested that the American Tobacco Company pull his card from circulation, leading experts to believe that only 50 to 200 of these cards were ever produced. Most of them are likely in poor condition, destroyed, or lost. The last one sold in 2016 for over $3 million because of its scarcity.

Economic Aspects

The card manufacturing and printing industry has seen substantial monetization in recent decades, with various companies saturating the market with their products. But the real winners are often the ones controlling the printing process. Card production numbers are closely guarded secrets, making it challenging to gauge the true supply.

Collectors Universe, the parent company of PSA (Professional Sports Authenticator), offers some insight. In their 2020 annual report, they disclosed that coin and card authentication and grading accounted for over 90% of their revenues. This suggests that card grading has become more lucrative for companies like Collectors Universe, potentially indicating increased card production.

In 1998, Collectors Universe reported annual revenue of $10.989 million, which grew to $78.891 million by 2020. While revenue growth doesn’t directly confirm increased card production, it aligns with the general trend of the card collecting world.

Gary Vaynerchuck Shares His Value Determinants

Value in card collecting is not solely dependent on the player’s legacy but also on factors such as rarity, arbitrary underproduction, and card grade. For instance, a Kobe Bryant 1996–97 Topps Chrome rookie card, graded perfectly, can sell for up to $200,000. These cards are highly sought after because of their rarity and exceptional condition.

Market Manipulation and Risks

The sports card industry is not without its controversies. Market manipulation, shill-bidding, card cutting, and trimming have all been alleged. The FBI has even become involved, issuing subpoenas to auction houses, authentication firms, and dealers suspected of submitting altered cards for auctions. Companies like PSA and PWCC have faced accusations of unethical practices.

To navigate this unpredictable market, one must exercise caution and thoroughly research cards and sellers. Trusting the grading process is essential, as is choosing reputable grading companies like BGS.

Supply and Rarity

The notion of buying cards at the end of a franchise’s popularity is not necessarily a reliable investment strategy. Valuable cards often arise from unexpected circumstances, misprints, or low production numbers. Predicting these factors is nearly impossible, and it takes years for cards to appreciate significantly.

What to Look for Instead

For those interested in card collecting, it’s essential to be realistic and view it as a hobby rather than an alternative investment. Focus on classic, time-tested collectibles, such as vintage baseball cards from the early 1900s. Avoid modern cards of young players, as their value can be highly volatile. Stick to cards that have been vetted by the collecting community, prefer BGS grading, and exercise caution with sellers like PWCC.

Ultimately, card collecting should be enjoyed for the passion it brings rather than relying on it as a surefire investment. The market is unpredictable, and while some cards may appreciate significantly, there are no guarantees in this niche and largely unregulated industry.

Photo Credit Brian Jones // Unsplash