Renowned artist James Fiorentino has teamed up with Collectable, a pioneering platform that introduces fractional ownership of sports memorabilia to the investment market. This collaboration allows Fiorentino, recognized for his exquisite sports artistry including depictions of icons like Mickey Mantle and Muhammad Ali, to broaden his reach to a more diverse audience, now accessible through Collectable’s platform. This marks Collectable’s initial venture into the realm of sports art.

Collectable, established in September 2020, has been a conduit for providing fractional access to celebrated sports collectibles within the investment community. Since its inception, the platform has garnered engagement from 70,000 users, leading to transactions amounting to $50 million.

Ezra Levine, the CEO of Collectable, emphasizes the platform’s role in democratizing the sports collectibles domain, fostering financial inclusivity even during challenging periods. The resilience of collectibles, evidenced by their performance post-dot-com bubble, after 9/11, during the 2008 financial crisis, and through the COVID-19 pandemic, underscores their enduring value.

The sports memorabilia market has flourished, reaching a staggering $24 billion, surpassing traditional stock and bond sectors in year-on-year growth. The PWCC 500, a premier trading card index, has consistently outperformed the S&P 500 since 2008.

Recent years have witnessed a surge in high-value sales, with 21 of the top 25 record-breaking transactions occurring in the past three years. Notable examples include the 2019 sale of the original Olympic Manifesto for $8.8 million and the exchange of a Honus Wagner baseball card for $6.6 million in 2021.

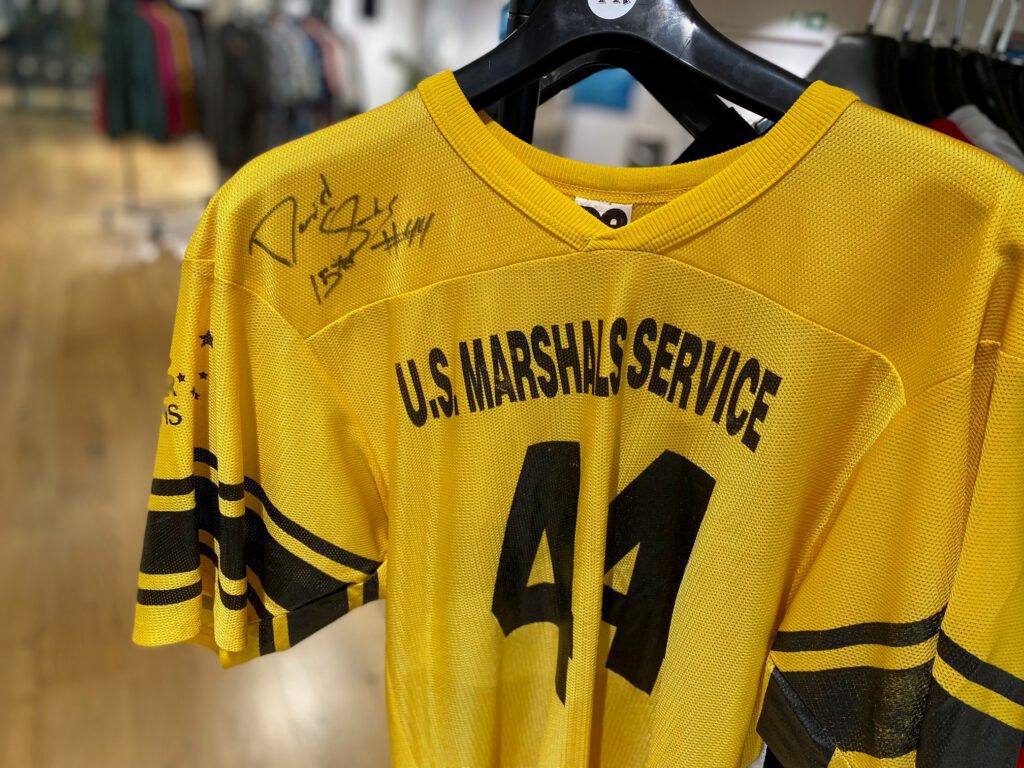

Collectable’s accomplishments are underscored by significant acquisitions such as Wilt Chamberlain’s autographed school uniform, Muhammad Ali’s WBC Championship Belt, and Johnny Unitas’ autographed jersey, all brokered within the platform’s inaugural year. Among its highlights is the Babe Ruth 1914 sports card, privately sold for $5.2 million and currently valued at $10 million on Collectable’s platform, showcasing a remarkable 60% average return on investment.

The convergence of art and sport, a tradition dating back to ancient Greece, is experiencing a modern resurgence in the investment landscape. Collectable leverages its experts to curate assets, secure SEC IPO filings, and offer equity shares starting at just $5, rendering sports collectibles accessible to a broader audience.

As the market evolves, the criteria for collectors have shifted from survival rates to limited editions with documented manufacturer numbers. Additionally, emotional connections to artifacts have transformed due to increased investment-oriented approaches. This trend accelerated during the pandemic, driven by heightened interest, increased media coverage, and shifts in spending habits.

A significant industry move was Fanatics’ acquisition of Topps in early 2022 for an estimated $500 million, ending Topps’ six-decade-long trading card dominance and marking Fanatics’ entry into the collectibles sphere. Looking ahead, the collectibles market anticipates growth in game-used items such as jerseys, helmets, and bats, which offer a unique connection to athletes and their historical achievements.