When COVID-19 shut down the world, few expected one of the biggest beneficiaries would be… trading cards. But as people stayed home, rediscovered old hobbies, and watched “The Last Dance,” prices for iconic sports cards – especially Michael Jordan rookie cards – skyrocketed. What was once a nostalgic pastime became a global investment trend.

Pre-COVID: The Calm Before the Storm

Before the pandemic, even legendary cards had moderate value. A PSA 10 graded 1986 Fleer Michael Jordan rookie card sold for about $40,000 USD in 2019. Collectors knew the value – but it wasn’t mainstream.

2020: COVID + The Last Dance = Market Explosion

Then came lockdowns, and with them, The Last Dance – ESPN’s documentary on Jordan’s career. It reignited passion and attention. Combined with the rise of digital auction platforms like Goldin Auctions and eBay, the card market exploded.

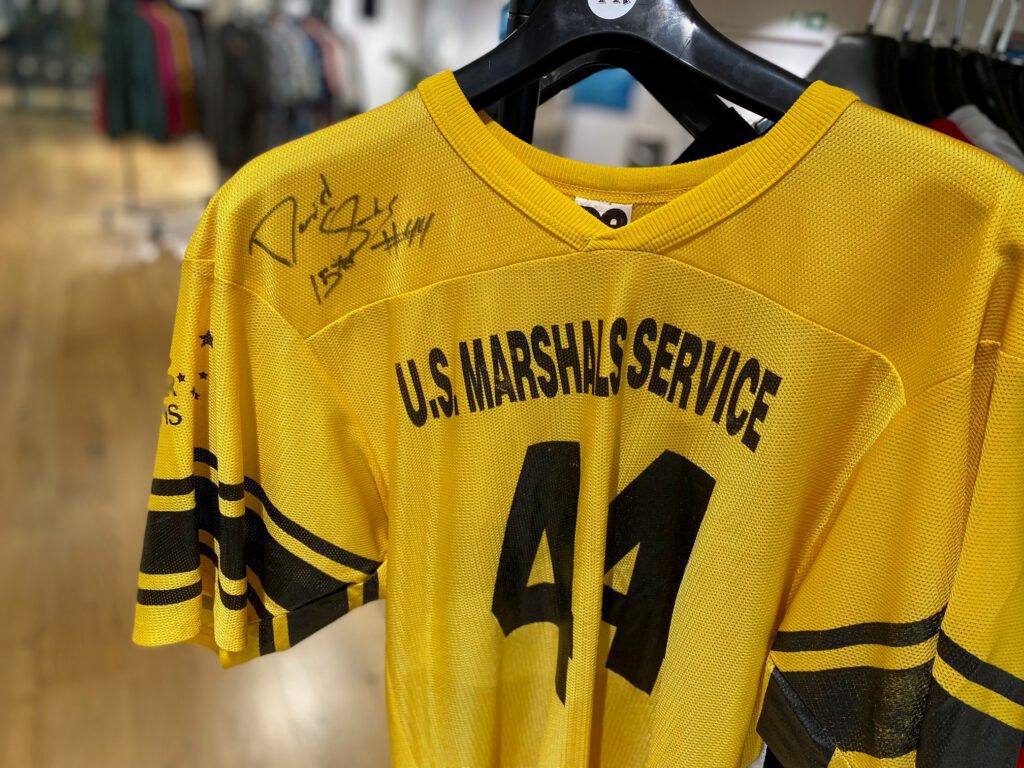

Within months, the same Jordan rookie card reached $200,000, according to Yahoo Sports. In February 2021, a signed Jordan card fetched $1.44 million at Heritage Auctions, setting a record.

High-Performing Teams – Off the Court, Too

One factor often overlooked: leadership and community. The trading card ecosystem now includes high-performing collectors and investor groups, many of whom treat cards like assets. Michael Jordan himself has always represented excellence – and now, his cards have come to symbolize high performance in the collectibles market.

Why Prices Skyrocketed: More Than Just Hype

- Nostalgia + time at home: Collectors revisited childhood passions.

- Cultural relevance: Jordan’s legacy was reintroduced to a new generation.

- Alternative investments: With stocks volatile, cards became a tangible store of value.

- Influencer promotion: Figures like Gary Vaynerchuk gave the market mainstream credibility.

Will It Last? Yes – But With Nuance

While some cards dipped post-2021 peak, high-grade, iconic cards remain stable. Market analysts estimate the global sports trading card market could grow from $44B in 2023 to $100B by 2027.

Jordan cards, in particular, are still in demand – and not just for nostalgia. They’re considered blue-chip collectibles with long-term upside.

FAQs

How much is a Michael Jordan rookie card worth now?

As of 2024, a PSA 10 graded 1986 Fleer Jordan rookie card ranges between $150,000 and $250,000, depending on market conditions.

Why did trading cards become popular during COVID-19?

Lockdowns gave people time to rediscover hobbies. Combine that with cultural moments like The Last Dance, and trading cards became both a passion and a form of investment.

Are Michael Jordan cards still a good investment?

Yes – especially high-grade, authenticated rookie cards. They’re viewed as stable assets in the collectibles market.

What role did The Last Dance play in card prices?

It reintroduced Jordan’s legacy to a global audience, driving demand for his memorabilia, especially trading cards.