Sports collectibles, which has already proven to be a viable alternative investment, is poised to become an even more attractive prospect with the emergence of a highly anticipated marketplace. However, one must exercise caution, as the question arises: could this market overheat?

When considering sports collectibles as a potential investment avenue, it’s crucial to approach it with a clear understanding of the risks involved and invest only what you can afford to lose. The market can be volatile, with valuations experiencing significant fluctuations, and the timing of purchases or sales will ultimately dictate long-term success.

The exchange of sports memorabilia has been a tradition for over a century, and recent developments suggest that values may see a surge as a more efficient and liquid collectibles market takes shape. A noteworthy example of this is Fanatics, the multibillion-dollar e-commerce platform specializing in sports team merchandise, which plans to launch a collectibles events business next year.

Fanatics Events aims to create a sports equivalent of Comic-Con, featuring appearances by current and former players, panel discussions, and a vibrant marketplace. The company is capitalizing on the growing popularity of collectibles and has partnered with the entertainment giant Endeavor’s IMG unit for this event series.

Collectibles: A Viable Alternative Investment

High-quality sports collectibles have long been regarded as a reliable alternative investment, and the creation of an accessible, high-visibility marketplace is expected to generate further momentum. However, any market that experiences significant growth also carries the risk of overheating.

During the pandemic, collectibles markets of various types, from cars to watches to NFTs, experienced an upswing. Individuals, confined to their homes, turned their hobby of collecting into a business opportunity. Where opportunities arise, substantial investments often follow.

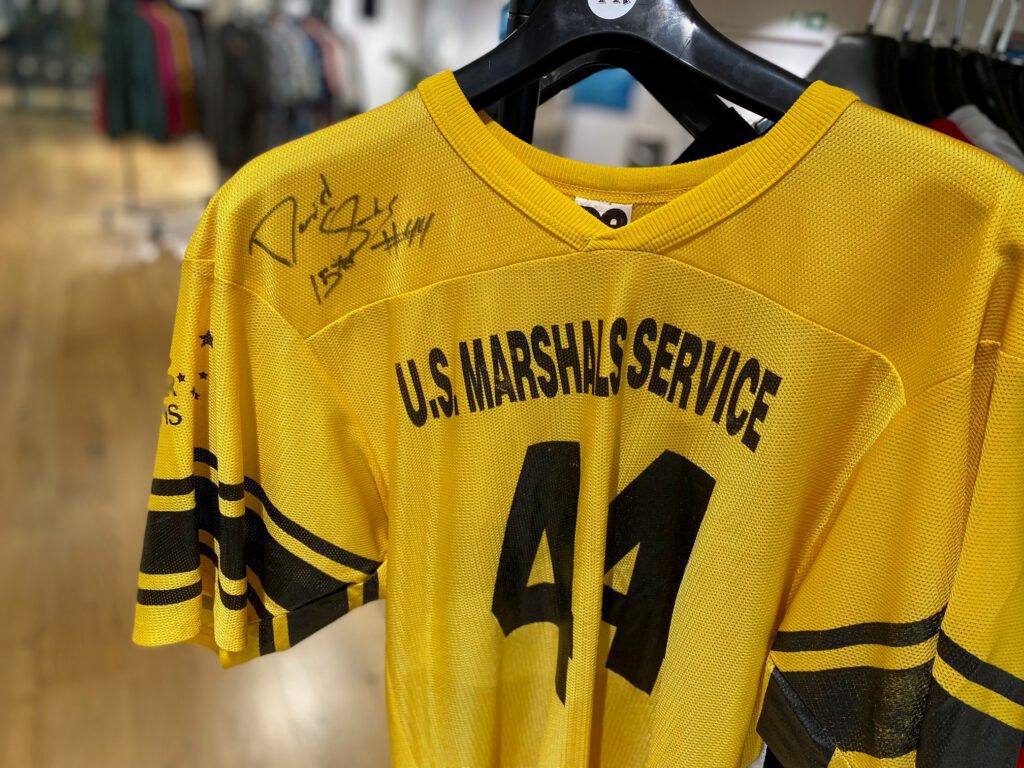

The sports collectibles market is showing signs of increasing organization. There is a tiered hierarchy of players, including legends, potential future legends, and current stars.

The true legends of their respective sports, such as baseball Hall of Famers Babe Ruth and Mickey Mantle, are considered blue-chip assets. These players’ memorabilia, due to their vintage and rarity, are likely to appreciate in value over time.

Memorabilia from current sports stars with proven track records, such as NBA players LeBron James and Steph Curry, fall a level below the likes of Ruth and Mantle. These players are currently at the peak of their careers, and their memorabilia prices have been driven up accordingly. However, their legacies are secure due to their sustained performance, and they are likely to become blue-chip assets in the future.

Potential Upside with Some Risks

Items associated with star players who do not maintain top-tier status for an extended period may offer potential upside but come with greater risks, similar to investing in smaller technology stocks. Some may eventually establish themselves as the best in their sport, while others may fade too quickly to become true legends.

Older cards carry a scarcity value, as they were produced in limited quantities at the time. The future trajectory of newer players is more challenging to predict. For instance, popular outfielder Aaron Judge has a strong, albeit brief, track record and plays for the New York Yankees in a media hub. The question is whether he can sustain his fame and extend his performance record. Products associated with him currently have upward price momentum, but their future trajectory is less certain.

Unique Characteristics of the Sports Collectibles Market

The sports memorabilia market possesses unique characteristics. Unlike stocks, collectibles derive their value from a passionate base, akin to fine art.

The introduction of Fanatics Events is likely to have a significant impact on the market, as a larger marketplace offers the potential for increased transaction volumes and greater transparency. Liquidity has been a concern in this market, and while these events may not completely eliminate this issue, they represent a step in the right direction.

Including sports collectibles in an investment portfolio can be a prudent choice, but it’s advisable not to allocate a substantial portion to them. Those who collect memorabilia as a hobby and see value in owning it might consider dedicating around 10% of their portfolio to collectibles. This is a reasonable level of risk.

Furthermore, it’s wise to focus the collectibles portfolio on blue-chip stars. Full disclosure: I personally own a pair of Muhammad Ali’s fight-worn trunks. Given his status as an American icon, I have a strong belief that their value will continue to rise, and my passion for boxing makes them a worthwhile investment.