When it comes to investments, there are traditional stocks and then there are collectibles. Collectors form a distinct group of investors, and it’s this very uniqueness that makes the world of collectibles both unpredictable and exciting. Certain categories of collectibles can even represent million-dollar investments. However, risks such as water damage, theft, and accidents can pose significant threats to a client’s collection. Here’s what insurance agents need to understand about safeguarding high-net-worth collections, and why a tailored collectibles insurance policy is the ultimate safety net for investors.

The Ascendance of Wine Collections Wine Collection Alternative investments, a departure from the conventional, encompass a range of financial assets, with stocks being the conventional example. The concept of using collectibles as an alternative investment avenue is relatively recent but has been steadily gaining traction. For aficionados of fine wines, an expanding wine collection marries history, culture, and flavor. While wine is swiftly becoming a sought-after alternative investment, its value appreciates over time due to aging, requiring years before yielding substantial returns.

Investment platforms dedicated to wine collections simplify the process for collectors to join the trend and cultivate their own wine portfolios. Vinovest, for instance, offers a user-friendly sign-up process through which specific wine vintages can be acquired via their website, bolstering nascent collections. Furthermore, utilizing a wine-investment platform like Vinovest provides comprehensive information about the wine, accompanied by the site’s proprietary algorithm that forecasts potential financial returns from each bottle – stocks cannot kept up with that.

The Profitable Facet of Fine Art Fine Art Painting Collectors of fine art are drawn to the aesthetics, emotional resonance, and the intricate narrative woven into each artwork. Additionally, the world of fine art offers lucrative opportunities for investors, which contributes to its appeal as an alternative investment category.

The potential for substantial returns from fine art investments is remarkable. In 2022, sales at Christie’s auction house alone amounted to nearly $4 billion from fine art collections.

The evolution of fine art has seen luminaries like Jeff Koons reshape the art landscape, catalyzing a surge in collecting activities and subsequent financial gains. Koons’ stainless steel sculpture “Rabbit” stands as an example, commanding a valuation of $91 million.

Popular Memorabilia Collections Star Wars Figurines Among the array of alternative investment options, memorabilia stands out due to its inherent sentimental value. Collecting memorabilia evokes nostalgia, tapping into cherished memories from the past. Similar to wine, the appreciation of memorabilia items can take years, or even decades. Some frequently collected types of memorabilia include:

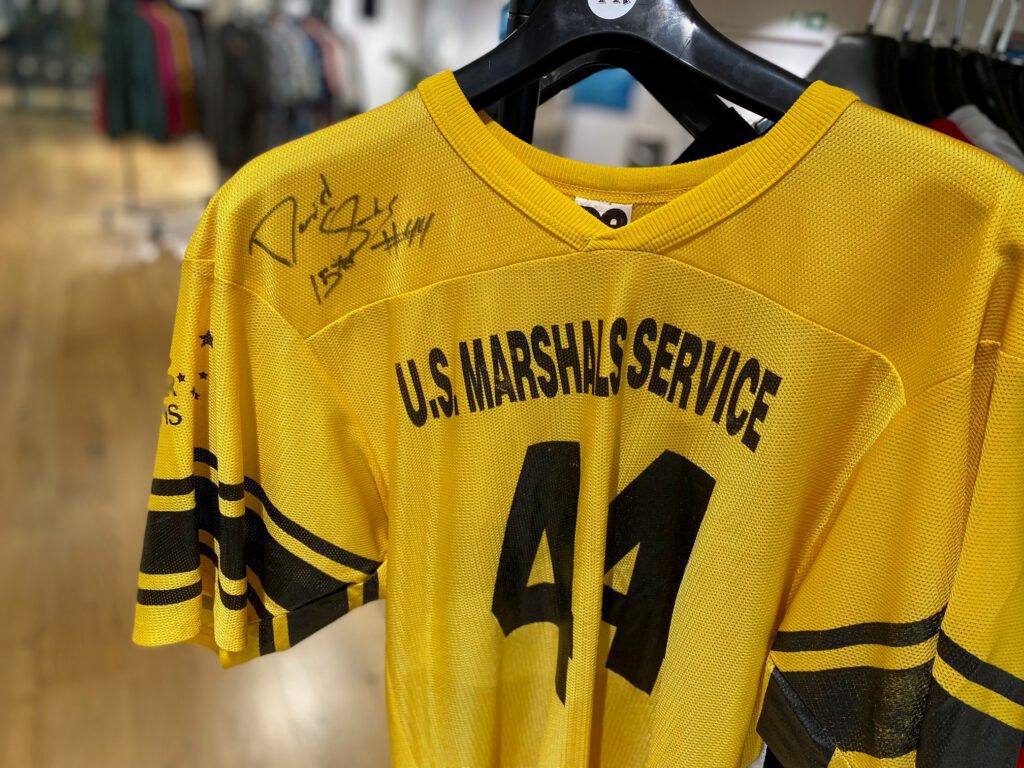

Sports Memorabilia: Items linked to sports heroes, teams, or historic events can fetch millions at auctions, driven by the emotional connection they evoke. Possessing a piece of sports memorabilia often feels like owning a tangible slice of sports history. While Major League Baseball (MLB) and the National Football League (NFL) draw the most collectors, value can be found in memorabilia from a wide range of sports. Popular sports memorabilia items include:

Jerseys: Beyond being symbols of fan loyalty, jerseys owned by famous athletes are frequently auctioned for substantial sums. A Michael Jordan jersey sold for over $10 million in 2022, setting a record for the highest price paid for a game-worn jersey.

Baseballs: Home-run baseballs and those signed by All-Star athletes have been sold at auction for millions. This has propelled baseballs to becoming sought-after collectibles.

Sports Figurines and Toys: Certain sports figurines, far from mere playthings, command significant prices, with values exceeding $40,000.

Hollywood and Pop Culture Memorabilia: Pop culture and Hollywood have woven themselves deeply into society, making memorabilia from these realms highly desirable. Some of the most coveted items include:

Autographed Photos: Collectors are willing to pay thousands for autographed photos of their favorite celebrities.

Scripts: Scripts from iconic films hold historical significance, with some fetching substantial sums at auction. For instance, a script from the film “To Kill a Mockingbird” sold for nearly $85,000.

Beside investing in stocks

Costumes: Film costumes are auctioned as rare collectibles, offering fans a tangible connection to cinematic history. Audrey Hepburn’s dress from “Breakfast at Tiffany’s” sold for over $900,000.

Toys: Toys, particularly those tied to pop culture phenomena like Star Wars, command high prices. A collection of Star Wars toys sold for nearly $350,000, well exceeding initial estimates. Should Your Clients Insure Their Collections? Sports Jerseys The unequivocal answer is yes, and here’s why: The dichotomy between high risk and high return is particularly evident in the world of collectibles. While some collectibles possess the potential for substantial profits reaching thousands or even millions of dollars, others are vulnerable to depreciation due to damage, theft, and loss.

As an insurance agent, guiding clients toward safeguarding the full appreciated value of their investments through a specialized collectibles insurance policy is paramount. Many collectors may not be aware of this distinct coverage, potentially relying on standard homeowner’s policies that aren’t tailored to protect appreciating assets. Moreover, high-value collections displayed in commercial settings require specialized coverage, often best provided by a dedicated monoline collectibles insurance policy.

A collectibles insurance policy offers protection in various scenarios:

Burglary: Irreplaceable collectibles may be compromised in a burglary, and standard homeowner’s or renter’s policies might inadequately cover them. A monoline collectibles insurance policy ensures coverage for the full value of the insured item based on an appraisal.

Accidental Damage: Damaged fine art and unique collectibles can be irreplaceable. Carriers specializing in collectibles insurance often possess the expertise to restore damaged items, preserving their value. For items beyond restoration, the policy covers the appreciated value, compensating the policyholder.

Fire, Wind, and Water Damage: Given the rise in catastrophic weather events, coverage for fire, wind, and water damage is vital for collectors of fine art and various collectibles. Investing beyond stocks could be great add on in your investment portfolio.

MiniCo’s Exclusive Collectibles Insurance Program offers coverage up to $1 million (and up to $4 million with a carrier referral) with all-risk coverage. Obtaining a quote is hassle-free, with no appraisal required for most collectible items. The online agent portal streamlines the process. Get a quote online or reach out to an underwriter for more information.