When it comes to investment opportunities, sports memorabilia has emerged as an alternative asset class with the potential to outperform the stock market. With its tangible and emotional value, limited supply, historical performance, global appeal, and diversification benefits, investing in sports memorabilia offers unique opportunities for substantial returns. In this article, we delve into specific examples that highlight the impressive growth and profitability of sports collectibles, surpassing traditional stock market investments.

The Honus Wagner T206 Baseball Card

Considered the holy grail of sports cards, the Honus Wagner T206 baseball card has become an icon in the world of sports memorabilia. With fewer than 200 known copies in existence, this card has consistently broken records at auction. In 2016, a PSA 5 graded Honus Wagner T206 card sold for an astonishing $3.12 million, showcasing the tremendous growth and value appreciation of this rare collectible. Such returns far surpass average stock market returns over the same time period.

The 1952 Topps Mickey Mantle Baseball Card

The 1952 Topps Mickey Mantle baseball card is another prime example of sports memorabilia outperforming the stock market. Initially priced at just a few cents, this card has skyrocketed in value over the years. In 2018, a PSA 9 graded Mickey Mantle card sold for a record-breaking $2.88 million. The remarkable appreciation in value of this iconic card demonstrates the potential for significant returns that surpass traditional stock investments.

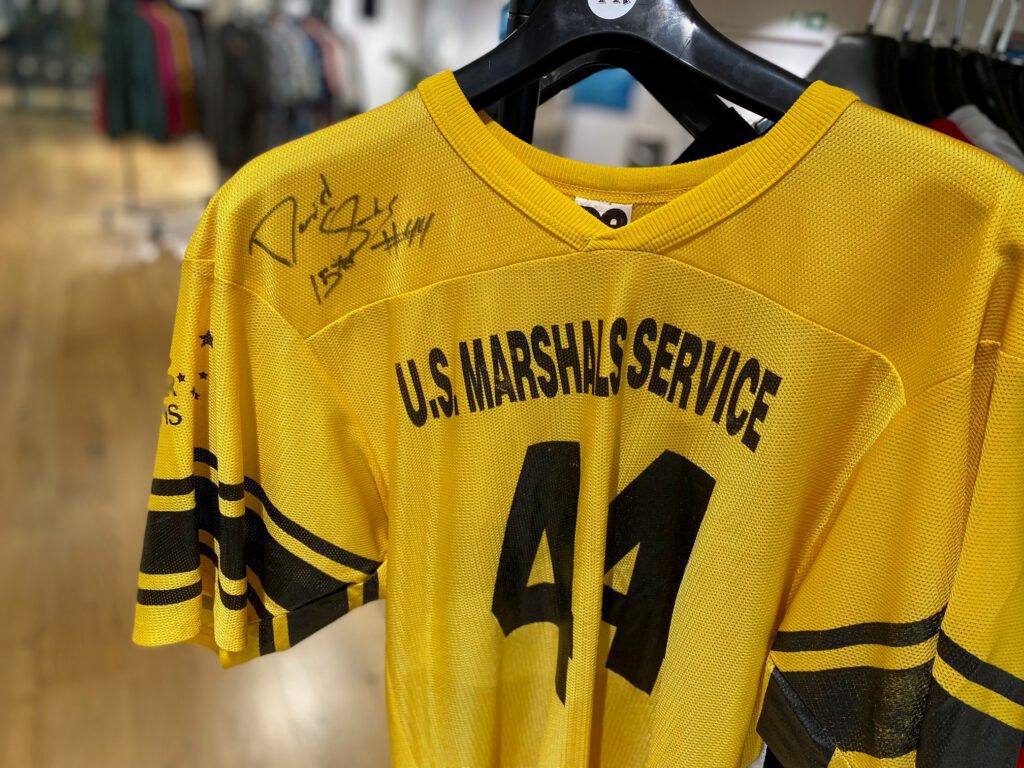

Game-Worn Jerseys and Equipment

Game-worn jerseys and equipment from legendary athletes have become highly sought-after collectibles. These items hold immense historical and sentimental value, making them desirable to sports fans and collectors worldwide. For instance, in 2020, the game-worn jersey of basketball icon Michael Jordan from his rookie season sold for $288,000 at auction. The allure of owning a tangible piece of sports history often drives prices far beyond initial expectations, positioning these items as profitable investments. The Last Dance Jersey was auctioned at Sotheby´s and made more than $10 million.

Historic Sports Memorabilia Auctions

Historic sports memorabilia auctions regularly demonstrate the significant returns that can be achieved by investing in collectibles. The sale of iconic items, such as Babe Ruth’s game-used baseball bat, Muhammad Ali’s signed gloves, or Pele’s World Cup-winning jersey, have consistently commanded staggering prices, surpassing stock market returns in many instances. These high-profile auctions showcase the growing demand for sports memorabilia and the financial opportunities it presents.

Investing in sports memorabilia provides an exciting and potentially lucrative alternative to traditional stock market investments. Examples such as the Honus Wagner T206 baseball card, the 1952 Topps Mickey Mantle card, game-worn jerseys, and historic sports memorabilia auctions highlight the impressive growth and profitability of sports collectibles. With their tangible and emotional value, limited supply, historical performance, global appeal, and diversification benefits, sports memorabilia offers investors a unique opportunity to generate substantial returns that often outperform the stock market. As the market for sports collectibles continues to thrive, smart investors recognize the potential for long-term growth and the enduring appeal of these tangible pieces of sports history.