AI investing refers to the use of artificial intelligence and advanced algorithms to make investment decisions. While AI has proven effective in certain areas of traditional financial markets, its application to sports memorabilia investments is more complex and limited due to the unique nature of this market. Let’s explore the factors that determine the effectiveness of AI investing for sports memorabilia:

- Lack of Historical Data: AI algorithms rely heavily on historical data patterns to make predictions. However, sports memorabilia items are inherently unique, and their value can be influenced by factors that are difficult to quantify, such as player performance, cultural significance, and market trends. Limited historical data and the absence of consistent pricing trends make it challenging for AI to accurately predict future values.

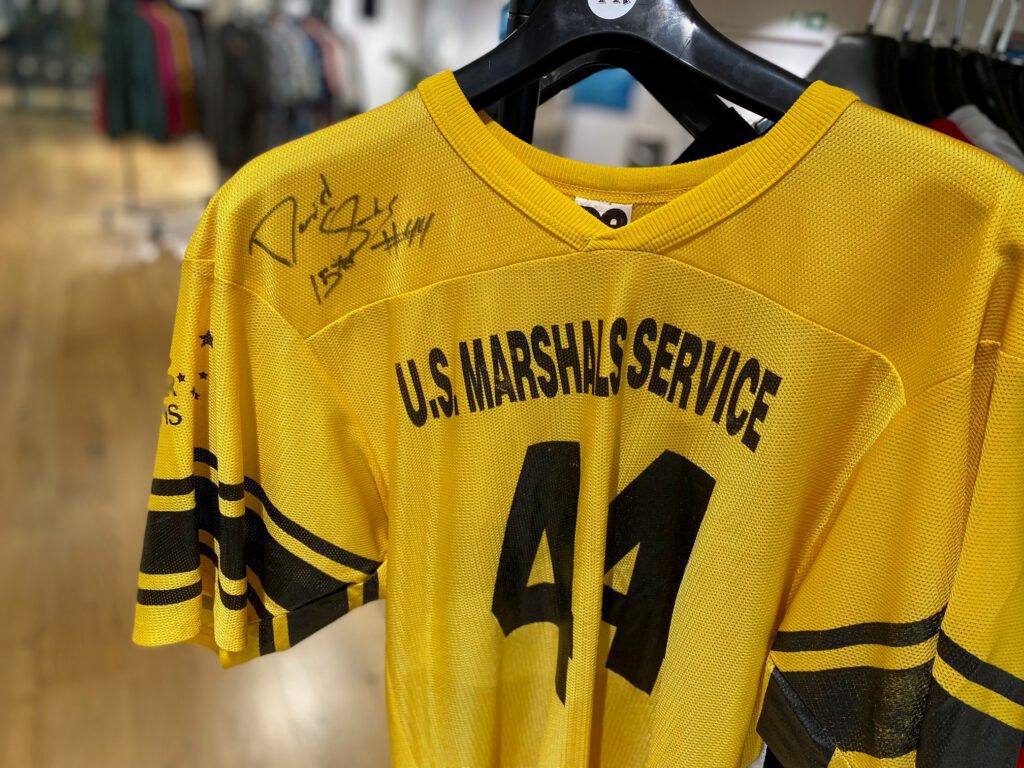

- Subjectivity and Emotional Value: Unlike stocks or commodities, the value of sports memorabilia is often driven by emotional connections and historical context. AI struggles to understand and incorporate these subjective factors into its calculations. An autographed jersey from a legendary player might hold sentimental value that’s not easily quantifiable, leading to discrepancies between AI predictions and real-world market behavior.

- Market Volatility and Trends: The sports memorabilia market can be highly volatile and influenced by trends that change rapidly. AI algorithms might not be able to keep up with these shifts, especially when they are driven by cultural moments or unexpected events. Predicting short-term fluctuations becomes challenging due to the unpredictability of player performances, injuries, and public interest.

- Unique Items and Rarity: Each sports memorabilia item is distinct, making it difficult for AI to generalize and predict values accurately. Unlike stocks, where each share is essentially the same, sports memorabilia items have varying degrees of rarity and uniqueness that are hard to quantify through algorithms.

- Lack of Data Standardization: Traditional financial markets benefit from standardized data sources, which AI algorithms can leverage to make informed decisions. In the sports memorabilia market, data sources are often decentralized, unstructured, and incomplete. This makes it challenging for AI systems to access reliable information for analysis.

- Human Interaction and Negotiation: Many sports memorabilia transactions involve negotiations and interactions between buyers and sellers. AI might struggle to capture the nuances of these interactions, which can heavily impact the final transaction price. The personal connection between collectors and their items is difficult for AI to replicate.

- Long-Term vs. Short-Term Outlook: AI investing often focuses on short-term gains, leveraging quick market movements for profit. However, sports memorabilia investments often require a longer-term perspective. Some items appreciate over years or decades, making it challenging for AI algorithms designed for short-term predictions to accurately gauge their potential value.

In summary, while AI investing has shown promise in certain traditional financial markets, its application to sports memorabilia investments is fraught with challenges due to the subjective, emotional, and rapidly changing nature of the market. The lack of standardized data, uniqueness of items, and the influence of cultural and emotional factors make it difficult for AI algorithms to provide reliable predictions in this context. As a result, investors interested in sports memorabilia are better off relying on their own research, expert opinions, and a deep understanding of the market’s complexities.