The trading card market has experienced a remarkable resurgence since 2020, transforming from a niche hobby into a booming global industry. What was once driven largely by nostalgia has evolved into a fast-moving market shaped by investment potential, limited releases, and growing cultural relevance.

North America plays a dominant role in this expansion, with collectors in the region accounting for nearly 40 percent of the global trading card market. In the United States alone, more than 28 million people actively collect cards, spanning all age groups. From seasoned adult collectors to younger enthusiasts just discovering the hobby, demand continues to grow.

New Releases Fuel Collector Demand

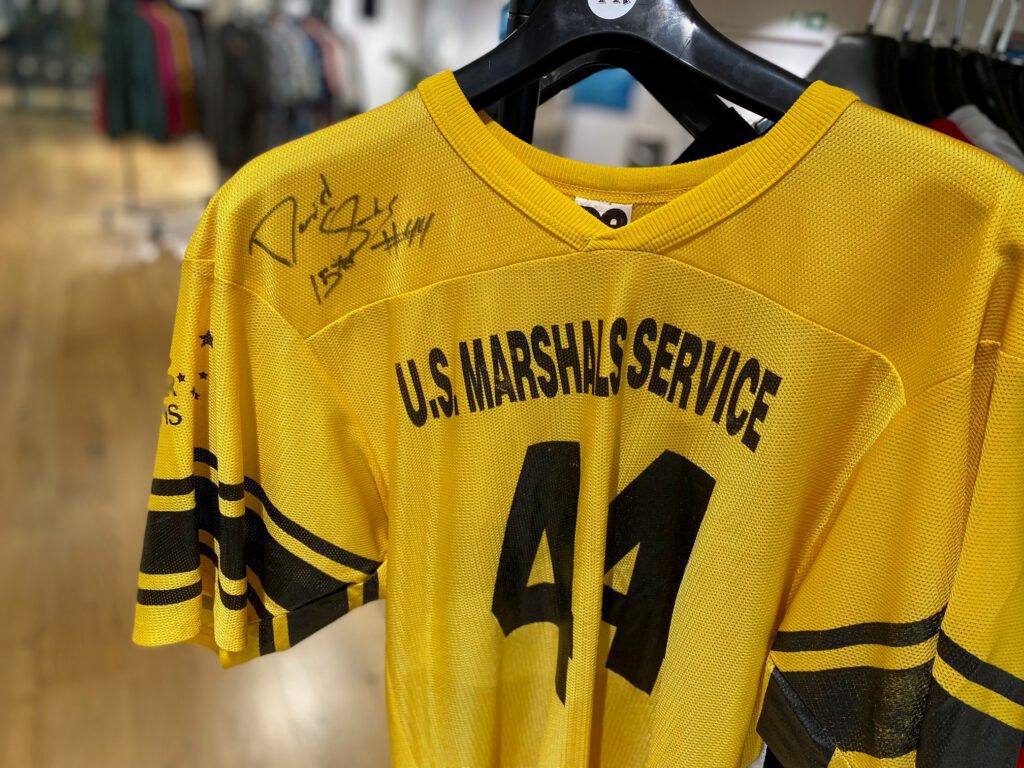

Collectors are particularly drawn to new and visually striking releases. Recent attention has focused on premium football cards featuring legendary NFL players such as Randy Moss and Brett Favre, often paired with bold cityscape designs. These high-profile cards, especially limited “case hits,” are prized for both their aesthetic appeal and liquidity on the resale market.

Small, independent card shops are feeling the pressure of this demand. Many sell out of inventory almost immediately after new shipments arrive, particularly on special release days. Sales growth has been significant, with some shops reporting year-over-year increases of more than 30 percent. Managing inventory has become a full-time challenge as collectors race to secure boxes before they disappear.

Rising Costs and Investment Appeal

The financial barrier to entry has also risen. Standard boxes of trading cards now commonly sell for prices ranging from under one hundred dollars to several hundred dollars per box, depending on the product and release. Despite the cost, newcomers continue to enter the market, drawn by the thrill of opening packs and the possibility of uncovering a rare card that far exceeds its initial value.

While many cards sell for modest sums, typically between ten and fifty dollars, the upper end of the market has reached staggering levels. Ultra-rare cards have been known to sell for tens of thousands, and in exceptional cases, even millions of dollars. This potential for high returns has further blurred the line between hobby and investment.

Trends Shaping 2026

Looking ahead, cards featuring “Greatest of All Time” athletes are expected to dominate interest in 2026. Established icons such as Tom Brady, LeBron James, and Michael Jordan remain highly sought after, while newer stars like NBA standout Victor Wembanyama are rapidly gaining traction among collectors.

Another growing bottleneck in the industry is card grading. Due to overwhelming demand, collectors often wait four to six months for rare cards to be professionally graded before resale. In response, artificial intelligence is increasingly being introduced to speed up the grading process. While this technology promises efficiency, it has also sparked debate within the community, particularly among traditionalists who value human judgment and tactile evaluation.

What Comes Next

The trading card industry is poised for another major milestone in April, when a major licensing shift will make a new brand the official card producer for the NFL. Anticipation around this release is already building, reinforcing the idea that momentum in the market is far from fading.

As the hobby continues to evolve, trading cards remain at the intersection of sports culture, art, technology, and finance. Whether driven by passion, nostalgia, or profit, collectors show no signs of stepping away anytime soon.